This site contains affiliate links, view the disclosure for more information.

In a modern-day evolving economic landscape, small businesses have increased rapidly in popularity, clearly personifying entrepreneurial spirit and innovation like never before. From artisanal startups to well-versed in tech ventures, the temptation behind small businesses lies in their flexibility, personalized service, and ability to satisfy niche markets.

This rise in popularity can be attributed to quite a few factors, including technological advancements, the escalating trend towards supporting local businesses, and the increasing aspirations for unique products and experiences.

In the middle of this entrepreneurial fervor and passion, one common challenge keeps at it the need for coherent financial management. Many small business owners and fresh entrepreneurs find themselves struggling with multiple tasks, from customer acquisition to product development, often leaving little time for them to handle and manage finances.

This is where FreshBooks comes in, offering a panoramic solution tailored specifically for small businesses seeking to simplify their financial processes. By automating invoicing, tracking expenses, and providing insightful financial reports, FreshBooks empowers you to focus more on growing your business and less on tedious administrative tasks.

Effective financial management is vital and foremost for small businesses to thrive and grow sustainably in an increasingly competitive market. Well-planned financial management not only ensures the smooth operation of day-to-day activities but also provides insights that drive strategic decision-making.

With FreshBooks, you can achieve greater control over your finances, make informed decisions by getting acquainted with accurate data, and ultimately, better align your business for long-term success in today’s ever-evolving business landscape.

Table of Contents

ToggleWays FreshBooks Streamlines your Small Business Finances

FreshBooks revolutionizes small business financial management with its intuitive platform designed to streamline every aspect of your finances. From invoicing to expense tracking, FreshBooks offers a comprehensive solution tailored specifically for small businesses.

This post intends to help you discover how FreshBooks transforms the way you manage your small business finances with its 5 essential features.

Automating your Invoicing Processes

Efficiency is a key to staying ahead in the present day’s fast-paced business environment. FreshBooks offers a suite of powerful invoicing features designed to automate and streamline your billing processes, saving you time and ensuring accuracy.

FreshBooks’ invoicing features offer a comprehensive solution for small businesses looking to streamline their billing workflow. By automating invoicing processes for your small business, you can save time, improve cash flow, and focus on what you do best – running your business.

Let’s explore how FreshBooks can transform the way you handle invoicing tasks, from customizable templates to seamless integration with online payment platforms.

Invoicing features

FreshBooks simplifies the invoicing process with user-friendly tools that are intuitive to navigate, even for those new to accounting software. Whether you’re a freelancer, consultant, or small business owner, FreshBooks’ invoicing features are tailored to meet your specific needs. As of it, you can now easily say goodbye to manual invoicing and welcome a more efficient way of billing your clients.

Customizable invoice templates

With FreshBooks, you can create professional-looking invoices in minutes, thanks to its library of customizable templates. Personalize your invoices with your logo, brand colors, and preferred payment terms to reflect your business’s identity and professionalism. Whether you’re sending invoices for services rendered or product sales, FreshBooks’ invoice templates adapt to your unique invoicing needs.

Automatic invoice generation and delivery

Gone are the days of manually generating and sending invoices. FreshBooks automates your entire invoicing process, from creating invoices to delivering them to your clients’ inboxes.

All you need to do is set up recurring invoices for ongoing services or projects, and FreshBooks will handle the rest, saving you valuable time and ensuring prompt payment for your work.

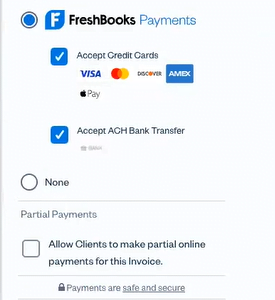

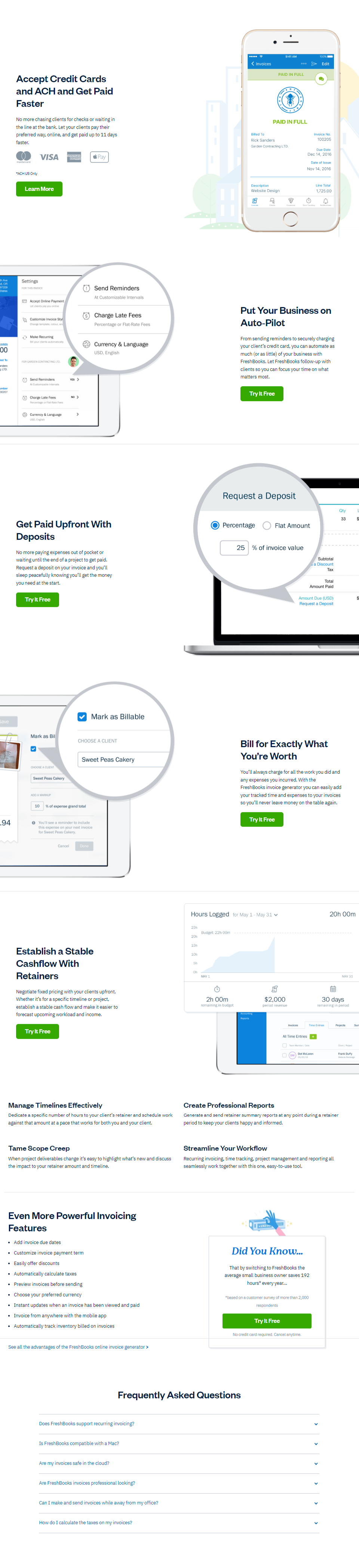

Integration with online payment platforms

FreshBooks integrates seamlessly with popular online payment platforms like PayPal, Stripe, and more, allowing your clients to pay invoices with just a few clicks.

By offering multiple payment options, you make it convenient for your clients to settle their bills promptly, improving cash flow for your business. This cloud-based software even tracks payments automatically, keeping your records up-to-date with minimal effort.

Benefits of automating invoicing processes for small businesses

The benefits of automating your invoicing processes with FreshBooks are manifold. Not only does it make the process efficient and reduce the risk of human error, but it also improves your cash flow by ensuring prompt payment from clients.

With FreshBooks handling your invoicing tasks, you can focus your energy on growing your business and delivering exceptional service to your clients.

Tracking your Expenses with Ease

Small business owners understand the importance of diligent expense tracking for maintaining financial health. FreshBooks offers a suite of powerful tools designed to streamline this process, providing unparalleled ease and efficiency.

From automated receipt scanning to real-time expense monitoring, FreshBooks empowers entrepreneurs to take control of their expenses with confidence.

If you are a small business owner, FreshBooks’ expense tracking tools offer you a seamless and efficient way to manage your expenses, providing valuable insights and empowering you to take control of your finances with greater ease and reliance.

FreshBooks’ expense tracking capabilities

FreshBooks simplifies expense tracking by offering intuitive features that cater to your specific needs as a small business owner. With customizable expense categories and effortless data entry, you can easily record and organize your expenses, ensuring accuracy and efficiency in your business’s financial management.

Receipt scanning and expense categorization

Manual data entry and paper clutter have become a matter of the past. Today, FreshBooks’ receipt scanning feature allows you to effortlessly digitize receipts using your mobile devices. The platform then automatically categorizes expenses, eliminating the need for tedious manual sorting and ensuring that every expense is accurately accounted for.

Real-time expense monitoring

With FreshBooks, small business owners can access real-time insights into their expenses anytime, anywhere. The platform provides up-to-date expense reports and dashboards, allowing you to monitor your spending patterns and identify areas for improvement on the go.

Insights into spending patterns

FreshBooks goes beyond simple expense tracking by offering valuable insights into spending patterns. By analyzing historical expense data, the platform provides actionable insights that help you make informed financial decisions for your small business and optimize your spending habits for greater efficiency and profitability.

Advantages of efficient expense tracking for small business owners

If you are a small business owner looking to maintain financial stability and drive growth, FreshBooks’ efficient expense tracking is an essential feature you don’t want to miss.

With FreshBooks, you and your fellow entrepreneurs can save time, reduce errors, and gain valuable insights into your spending habits, ultimately empowering everyone to make smarter financial decisions and achieve long-term success.

Simplifying Time Tracking and Billing

Today’s fast-paced business environment requires small businesses to have efficient time tracking and billing to stay organized, optimize productivity, and ensure timely payments from clients. FreshBooks, as a leading cloud-based accounting software, offers you a comprehensive solution to simplify these crucial aspects of business management.

Let’s explore how this cloud-based accounting software streamlines time tracking and billing processes for your small business, allowing you to focus on what you do best – growing your business.

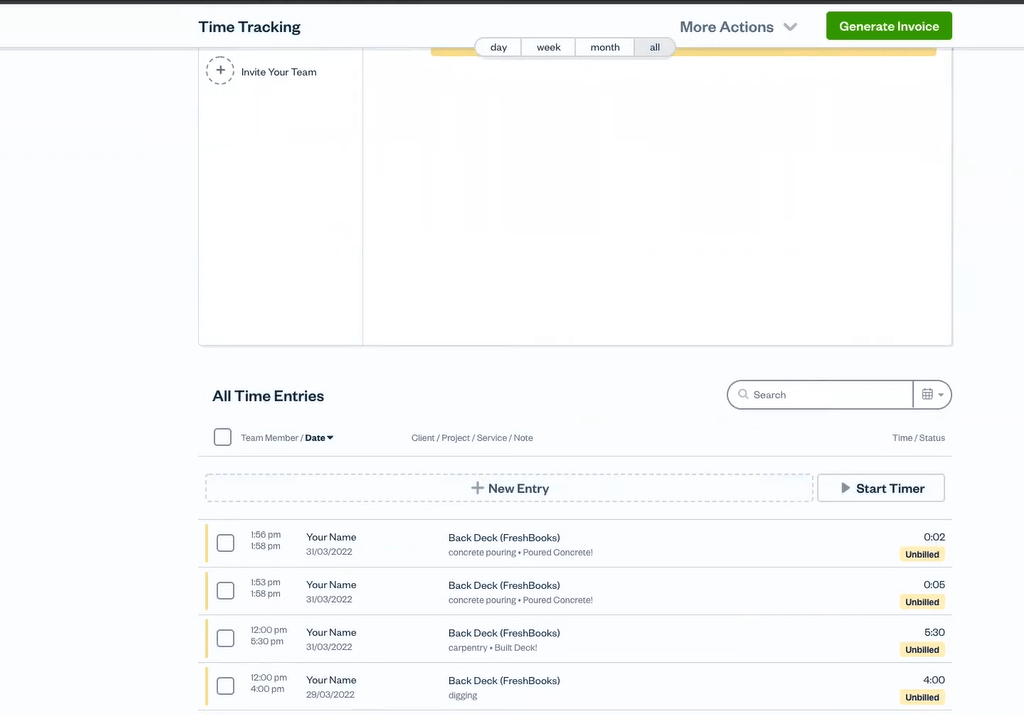

FreshBooks’ time-tracking tools

FreshBooks provides a range of user-friendly time-tracking tools designed to meet the diverse needs of small business owners. Whether you’re a solo entrepreneur or managing a team of employees, FreshBooks’ time-tracking features are flexible and intuitive, making it easy to monitor billable hours accurately.

Tracking billable hours accurately

With FreshBooks, tracking billable hours has never been easier. Whether you’re working on client projects, attending meetings, or completing administrative tasks, FreshBooks allows you to log your time with precision. This ensures that you’re compensated fairly for the work you do, ultimately contributing to better client relationships and improved cash flow for your business.

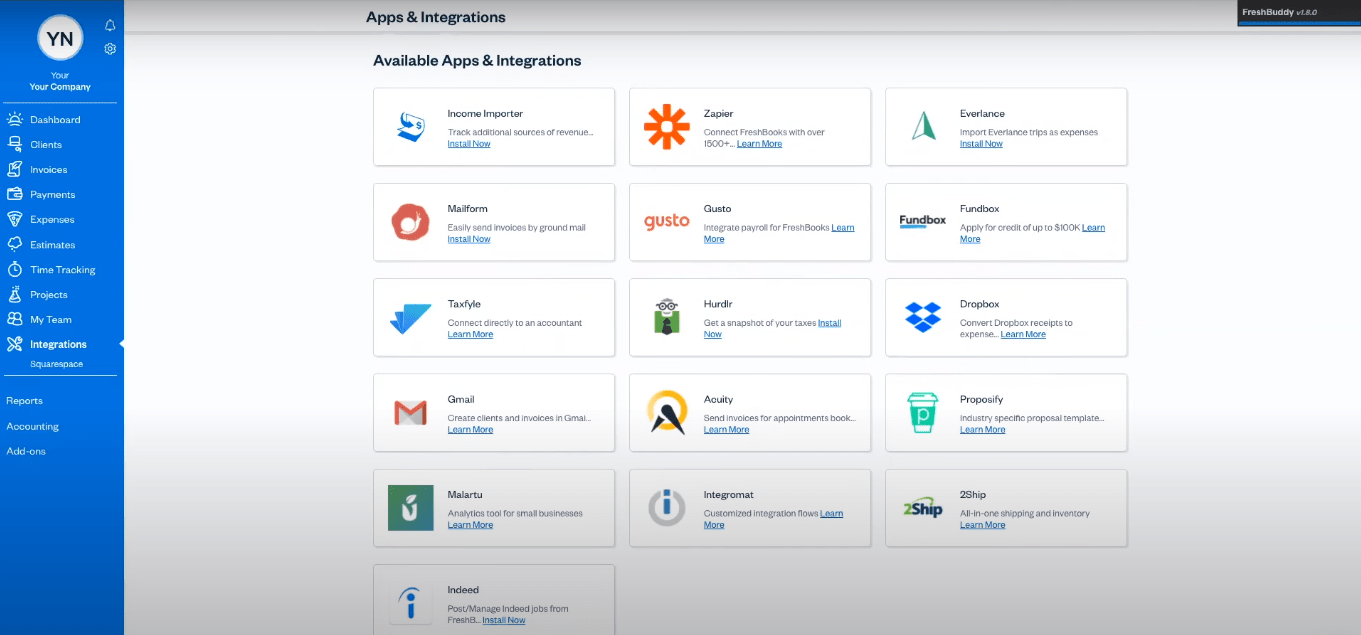

Integration with project management software

FreshBooks seamlessly integrates with popular project management software, enabling small business owners to streamline their workflow and consolidate their business tools.

By integrating FreshBooks with platforms like Trello, Asana, or Basecamp, you can track time directly within your project management dashboard, eliminating the need for manual data entry and ensuring that your time tracking is always up-to-date.

Automatic generation of invoices based on tracked time

One of the standout features of FreshBooks’ time tracking tools is their ability to automatically generate invoices based on tracked time. Once you’ve logged your billable hours, FreshBooks can instantly convert that time into an invoice, saving you time and effort in creating and sending invoices to your clients.

Importance of Streamlined time tracking and billing for small businesses

Efficient time tracking and billing are crucial for small businesses looking to maximize productivity and profitability. By simplifying the process of tracking time and generating invoices, FreshBooks helps small business owners focus more on delivering value to their clients and less on administrative tasks.

With accurate time tracking and streamlined billing processes, you can improve cash flow, enhance client satisfaction, and ultimately, drive growth and success for your business.

Enhanced Financial Reporting and Insights

In the ever-evolving landscape of small business management, access to accurate financial data and insightful reports is crucial for making informed decisions and driving growth. FreshBooks offers powerful tools to enhance financial reporting and provide valuable insights into your business’s performance.

Let’s explore how FreshBooks empowers small business owners with customizable financial reports, forecasting tools, and strategic insights to optimize their business strategies.

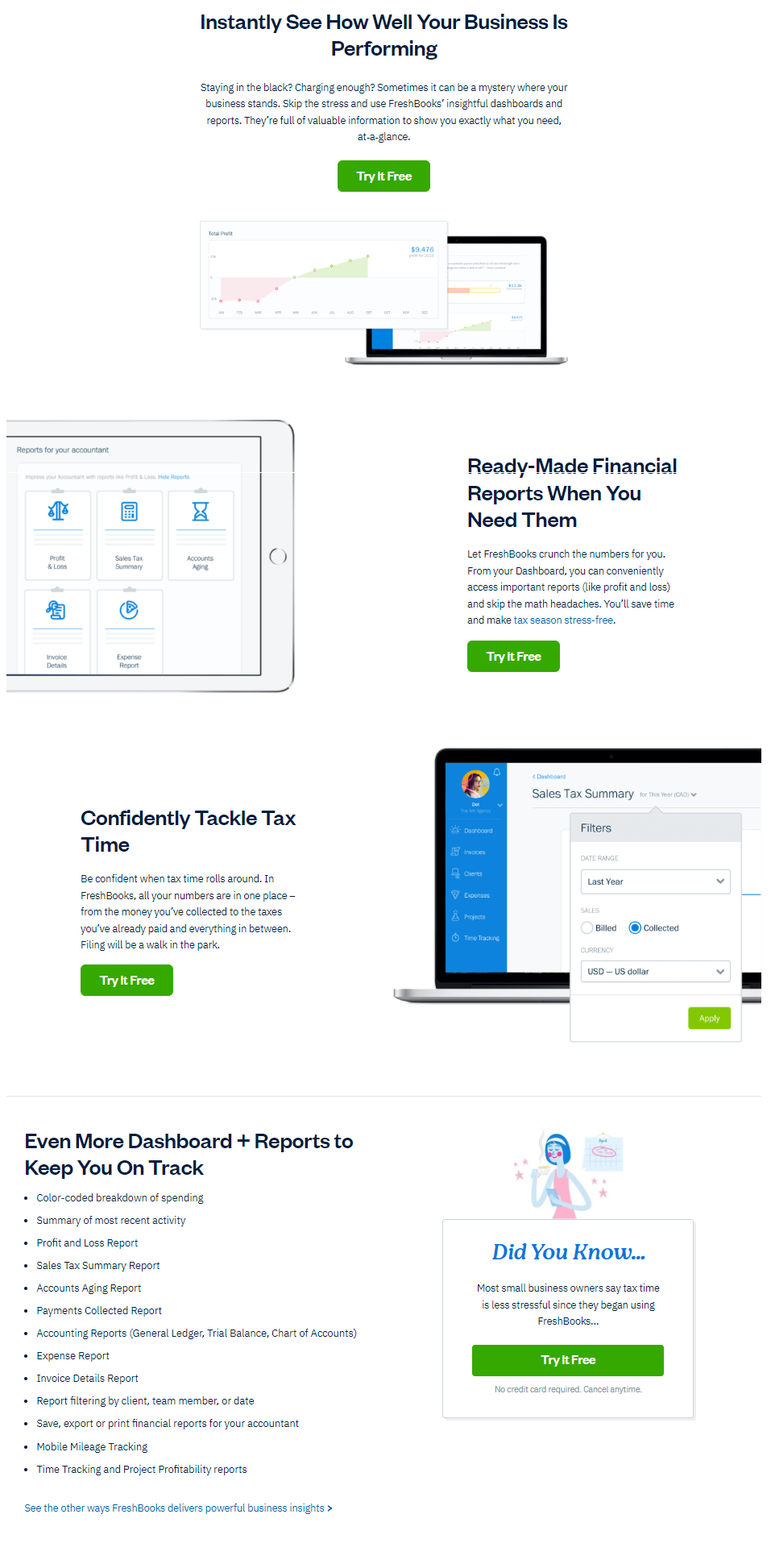

FreshBooks' reporting features

FreshBooks’ financial reporting features are designed to provide small business owners with a comprehensive view of their financial health. From profit and loss statements to balance sheets, FreshBooks offers a range of standard reports that can be customized to meet the unique needs of your business. With real-time data and customizable reporting options, you can gain valuable insights into your business’s financial performance at a glance.

Customizable financial reports

One of the key advantages of FreshBooks is its ability to generate customizable financial reports tailored to your specific business needs. Whether you need to track sales by client, analyze expenses by category, or monitor cash flow trends, FreshBooks allows you to create detailed reports that provide a deeper understanding of your business’s financial metrics.

Insights into business performance

With FreshBooks, you can gain valuable insights into your business’s performance and identify areas for improvement. By analyzing key metrics such as revenue growth, profit margins, and expense trends, you can make data-driven decisions that drive your business forward.

FreshBooks’ reporting tools empower you to track performance over time, identify patterns and trends, and adjust your strategies accordingly to achieve your business goals.

Forecasting tools for better decision-making

FreshBooks goes beyond basic reporting to offer forecasting tools that help you plan for the future with confidence. Whether you’re projecting sales for the next quarter or planning your budget for the year ahead, FreshBooks’ forecasting tools provide you with the insights you need to make informed decisions and drive business growth.

Utilizing financial reporting to optimize business strategies

By leveraging FreshBooks’ financial reporting and insights, small business owners can optimize their business strategies and drive long-term success.

Whether it’s identifying opportunities for cost savings, optimizing pricing strategies, or investing in growth initiatives, FreshBooks provides the data and insights you need to make strategic decisions that propel your business forward.

With FreshBooks, you can take control of your finances, gain valuable insights into your business’s performance, and drive growth with confidence.

Facilitating Seamless Collaboration and Client Communication

Effective collaboration and communication are essential for success in today’s fast-paced world of business. FreshBooks, a leading provider of cloud-based accounting software, offers a range of features designed to facilitate seamless collaboration and communication for small businesses.

Let’s explore how FreshBooks empowers teams to work together efficiently and enhances communication with clients through its intuitive platform.

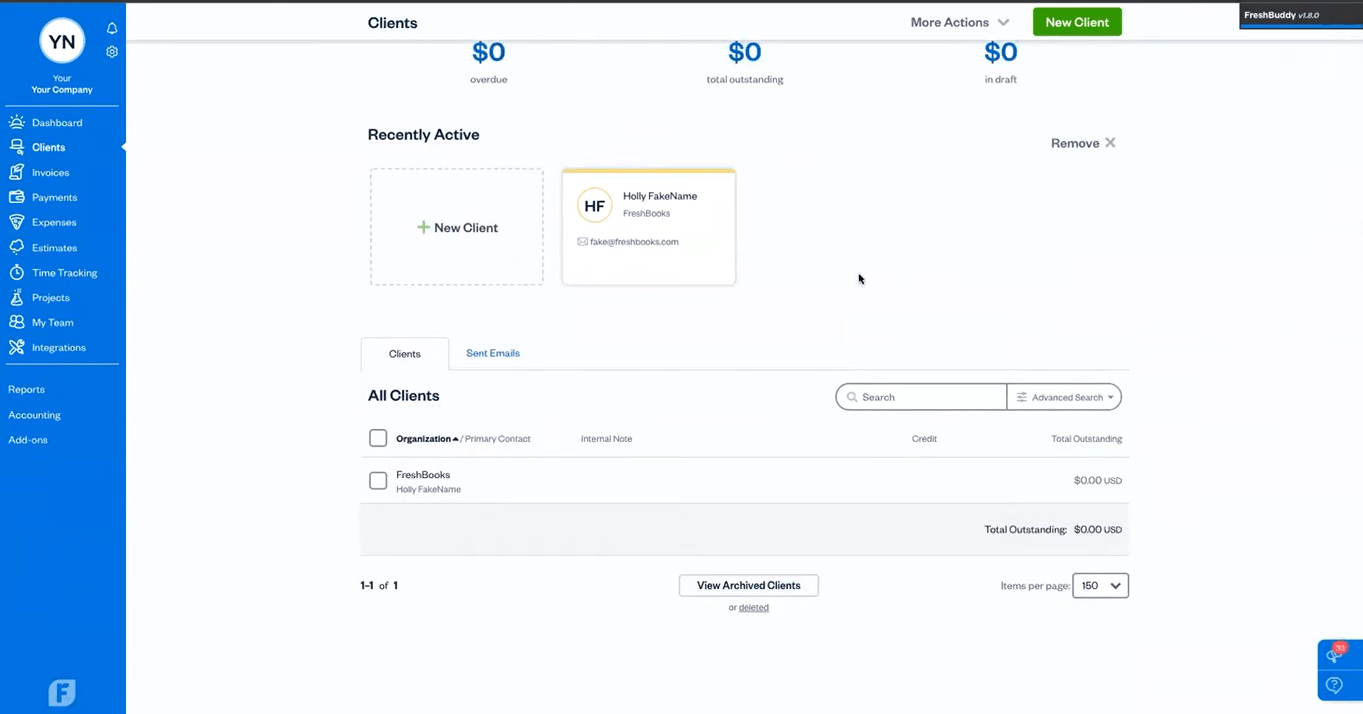

FreshBooks' collaboration features for teams

FreshBooks provides a variety of collaboration features that enable teams to work together seamlessly. Whether you’re collaborating with colleagues on a project or working with external partners, FreshBooks’ collaboration tools make it easy to share information, assign tasks, and track progress in real time.

With features like team messaging and file sharing, FreshBooks ensures that everyone stays on the same page, fostering a culture of collaboration and teamwork within your organization.

Client portal for easy communication and document sharing

FreshBooks offers a client portal that serves as a centralized hub for communication and document sharing with clients. Through the client portal, you can easily communicate with clients, share project updates, and collaborate on documents in a secure and organized environment.

This helps streamline communication with clients, eliminate the need for back-and-forth emails, and ensures that everyone has access to the latest information and updates.

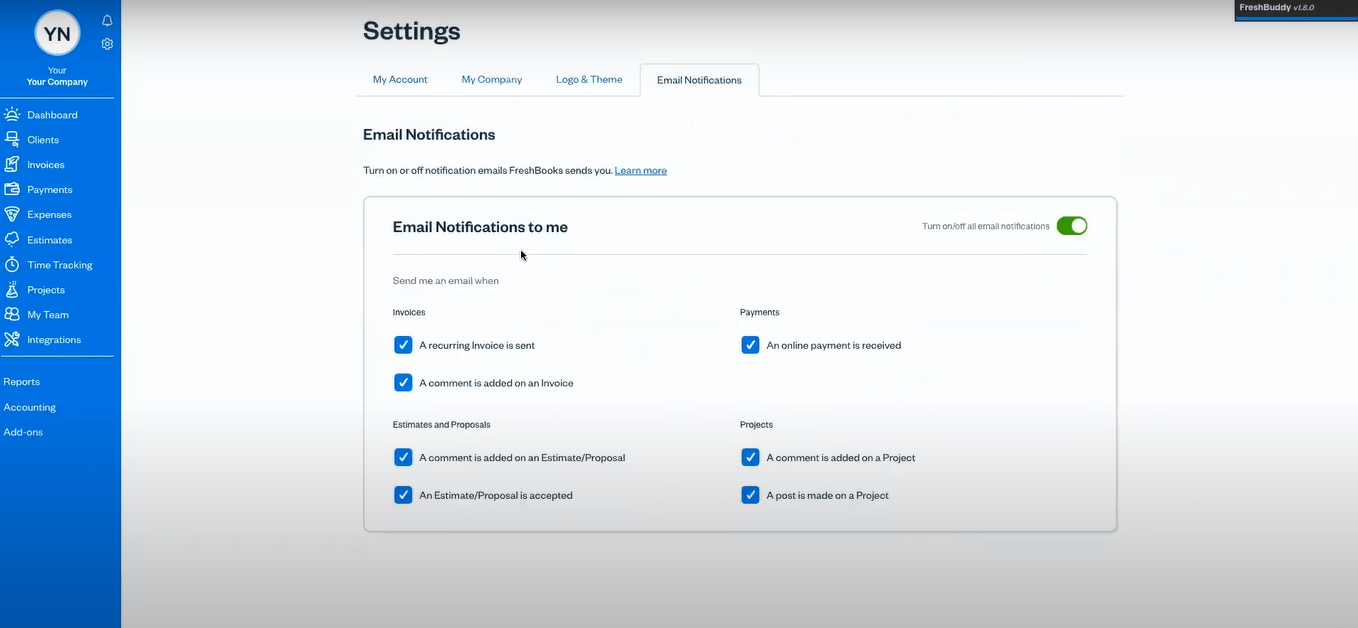

Streamlined communication through comments and notifications

FreshBooks streamlines communication by allowing users to leave comments and receive notifications directly within the platform.

Whether you’re discussing project details with your team or communicating with clients about invoice payments, FreshBooks’ commenting feature keeps all communication centralized and easily accessible.

Additionally, FreshBooks sends notifications for important events such as new invoices, payment reminders, and project updates, ensuring that you stay informed and responsive at all times.

Improving client relationships through enhanced communication

Effective communication is key to building strong client relationships, and FreshBooks helps you achieve just that. By providing a seamless communication experience through its platform, FreshBooks enables you to keep clients informed, address their concerns promptly, and provide exceptional customer service. This not only strengthens client relationships but also fosters trust and loyalty, ultimately leading to repeat business and referrals.

Benefits of seamless collaboration for small businesses

Seamless collaboration and communication offer numerous benefits for small businesses, including increased productivity, improved efficiency, and enhanced client satisfaction.

By leveraging FreshBooks’ collaboration features and client communication tools, you can streamline your workflow, deliver projects more effectively, and build stronger relationships with your clients. Ultimately, this leads to greater success and growth for your business in today’s competitive market.

Key Takeaways

As we conclude our exploration of how FreshBooks can streamline small business finances, it’s clear that this cloud-based accounting software offers a comprehensive solution tailored specifically to the needs of small business owners.

Throughout this blog post, the five key ways FreshBooks empowers small business owners to streamline their finances were highlighted which in short include:

- Automating Invoicing Processes

- Tracking Expenses with Ease

- Simplifying Time Tracking and Billing

- Enhancing Financial Reporting and Insights

- Facilitating Seamless Collaboration and Client Communication

Each feature contributes to a more efficient and streamlined financial management process, allowing small business owners to focus more on growing their businesses and less on tedious administrative tasks.

Using FreshBooks for financial management offers a multitude of benefits for small business owners, including:

- Increased efficiency through automation of invoicing and expense tracking processes

- Better decision-making with access to real-time financial insights and reporting

- Improved client relationships through streamlined communication and collaboration

- Enhanced productivity with simplified time tracking and billing tools

- Greater peace of mind with secure and reliable cloud-based accounting software

If you’re a small business owner looking to streamline your financial management processes and drive growth, we encourage you to give FreshBooks a try.

With its user-friendly interface, robust features, and dedicated support team, FreshBooks is the ideal solution for small businesses seeking to improve efficiency and achieve their financial goals.

Ready to experience the benefits of FreshBooks for yourself?

Sign up for FreshBooks today or try a free trial to see how it can transform your financial management processes and help you grow your business.

Even if you’re already using FreshBooks, there’s always more to explore! I’d love to hear about your experience and accomplishments with FreshBooks. Comment down below!

FAQs

Yes, FreshBooks is designed specifically for small businesses and freelancers looking to streamline their financial management processes.

Yes, FreshBooks offers a 30-day free trial for new users to explore its features and see if it meets their needs.

FreshBooks is ideal for a variety of small businesses, including consultants, freelancers, service-based businesses, and creative professionals.

Yes, FreshBooks has a mobile app available for iOS and Android devices, allowing users to manage their finances on the go.

Yes, FreshBooks offers customizable invoice templates and allows users to generate customized financial reports tailored to their specific business needs.

FreshBooks takes security seriously and employs industry-standard measures to protect user data, including encryption and regular security audits.

Yes, FreshBooks integrates with a variety of third-party business tools and apps, including payment processors, project management software, and CRM systems.

Yes, FreshBooks allows users to easily track expenses and upload receipts for reimbursement or tax purposes.

Yes, FreshBooks provides customer support via email and phone, as well as an extensive knowledge base and community forum for self-help resources.

FreshBooks offers tiered pricing plans based on the number of active clients, starting with a Lite plan for basic invoicing needs and scaling up to higher-tier plans with additional features and functionality.

Add a Comment